Micron Technology, Inc. (MU) is a leading American multinational corporation that specializes in the production of computer memory and computer data storage products. As a prominent player in the tech industry, Micron's stock has garnered significant attention from investors and market analysts alike. In this article, we will delve into the world of Micron Technology stock, providing an in-depth analysis of its current price, trends, and future prospects.

Company Overview

Founded in 1978, Micron Technology has established itself as a major manufacturer of dynamic random-access memory (DRAM) and flash memory. The company's product portfolio includes a wide range of memory and storage solutions, catering to various industries such as computing, networking, and mobile devices. With a global presence and a robust research and development infrastructure, Micron has consistently innovated and adapted to the evolving demands of the tech landscape.

Stock Price and Performance

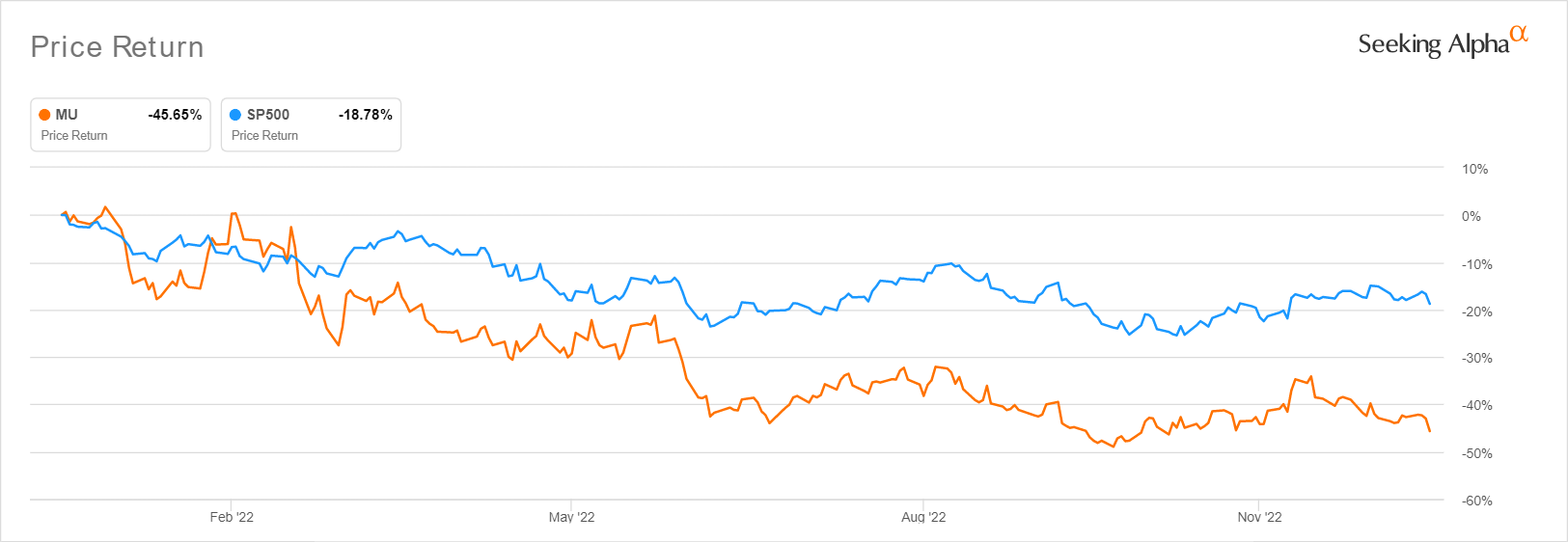

As of the latest trading session, Micron Technology's stock price is around $80, with a market capitalization of over $90 billion. The stock has exhibited a moderate level of volatility, with a 52-week price range of $40-$95. Over the past year, MU has demonstrated a significant rebound, with a year-to-date return of approximately 30%. This growth can be attributed to the company's strong quarterly earnings, strategic partnerships, and the increasing demand for memory and storage solutions.

Key Drivers and Trends

Several factors have contributed to Micron's stock performance and are expected to influence its future trajectory:

5G and AI Adoption: The growing adoption of 5G technology and artificial intelligence (AI) is driving the demand for high-performance memory and storage solutions, benefiting Micron's business.

Cloud Computing and Data Center Expansion: The increasing reliance on cloud computing and data centers has led to a surge in demand for memory and storage products, positioning Micron as a key player in this space.

Trade Tensions and Supply Chain Disruptions: The ongoing trade tensions between the US and China, as well as supply chain disruptions, have impacted Micron's operations and stock price. However, the company has been working to mitigate these risks and diversify its supply chain.

Stock Analysis and Outlook

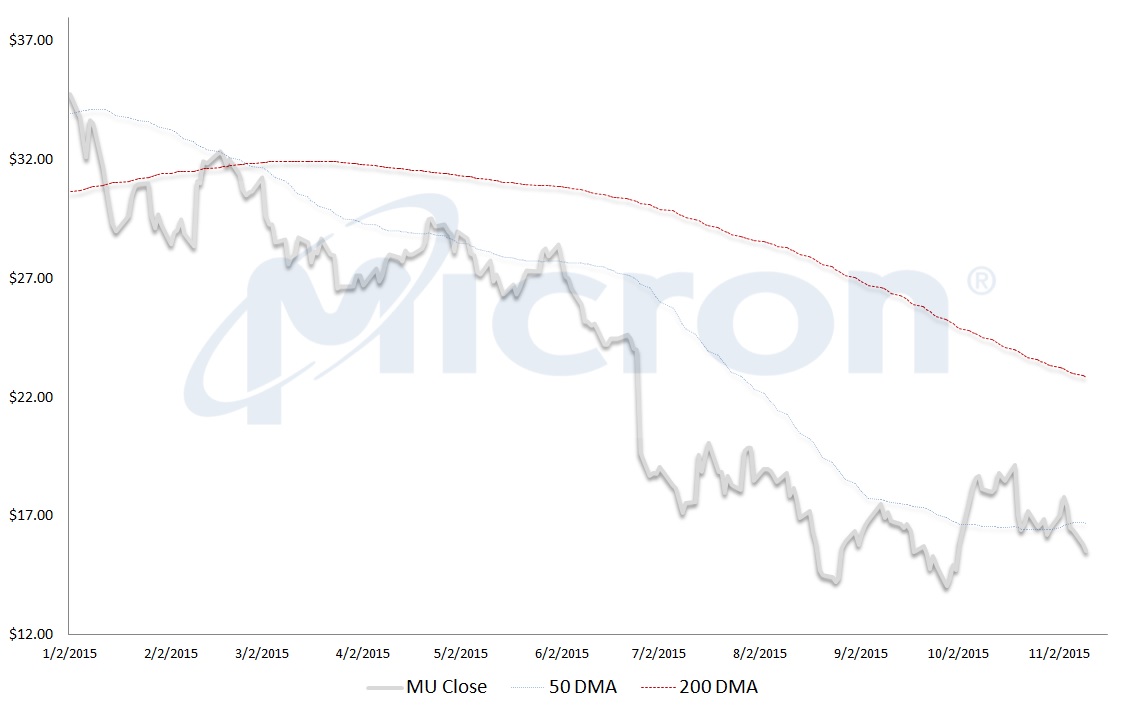

From a technical analysis perspective, Micron's stock has broken out of its resistance level and is currently trading above its 50-day moving average. The Relative Strength Index (RSI) indicates a moderate level of overselling, suggesting a potential buying opportunity.

Fundamentally, Micron's strong financial performance, combined with its strategic initiatives and growing demand for its products, supports a positive outlook for the stock. However, investors should remain cautious of potential risks, such as trade tensions and supply chain disruptions, which could impact the stock's performance.

In conclusion, Micron Technology's stock offers a compelling investment opportunity, driven by the company's strong fundamentals, growing demand for its products, and strategic initiatives. While risks and challenges exist, the stock's current price and trends suggest a positive outlook for investors. As the tech industry continues to evolve, Micron is well-positioned to capitalize on emerging trends and drive long-term growth.

Recommendation: Investors seeking exposure to the tech sector and memory and storage solutions may consider adding Micron Technology to their portfolio. However, it is essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

Disclaimer:

The views and opinions expressed in this article are for informational purposes only and should not be considered as investment advice. The stock market is subject to risks and uncertainties, and investors should always conduct their own research and consult with a financial advisor before making any investment decisions.