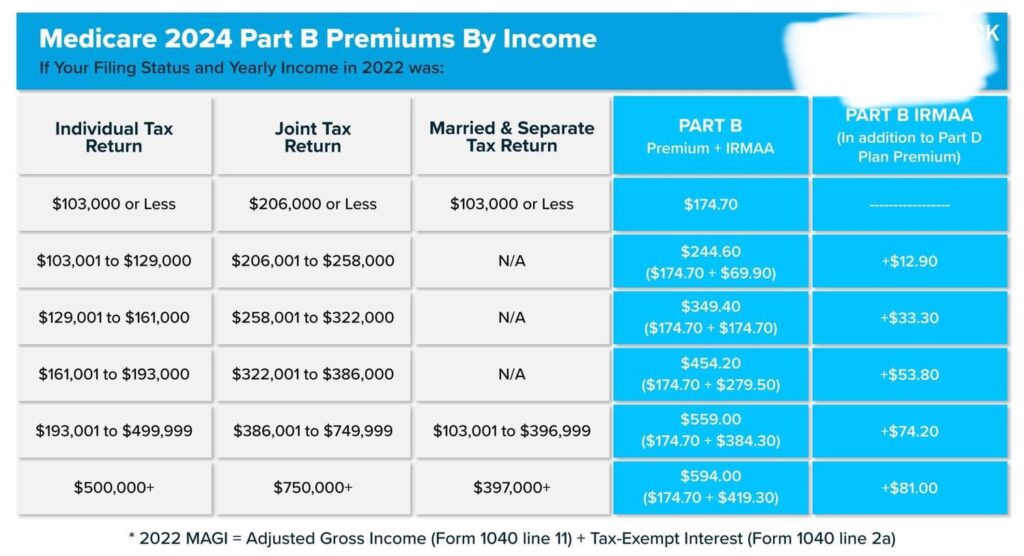

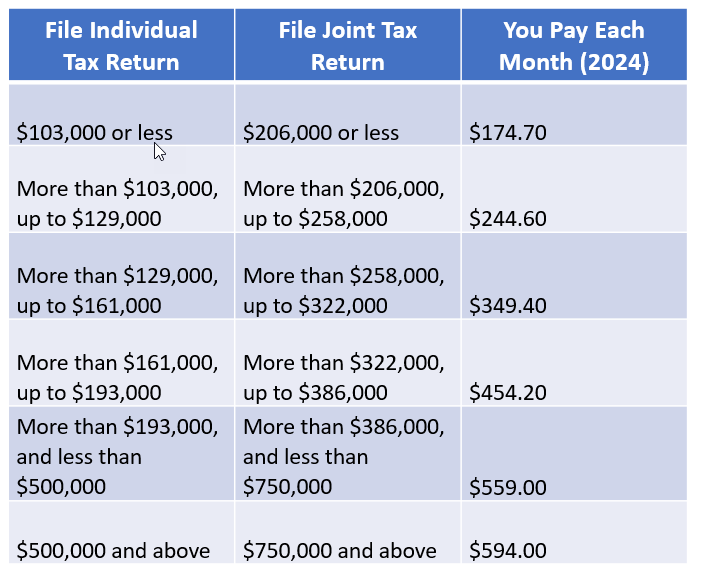

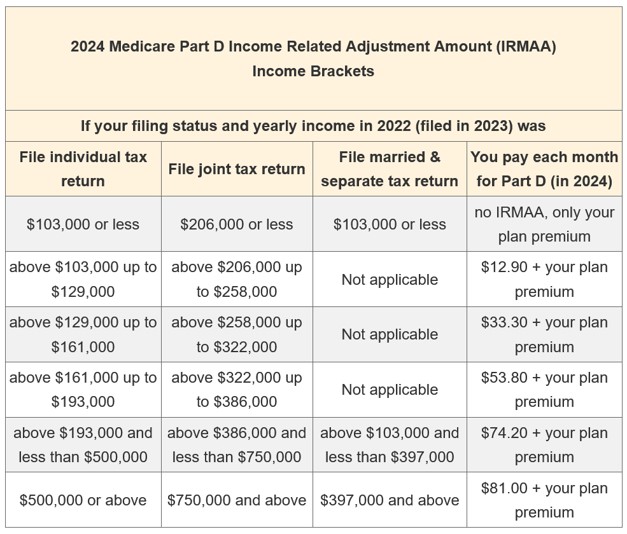

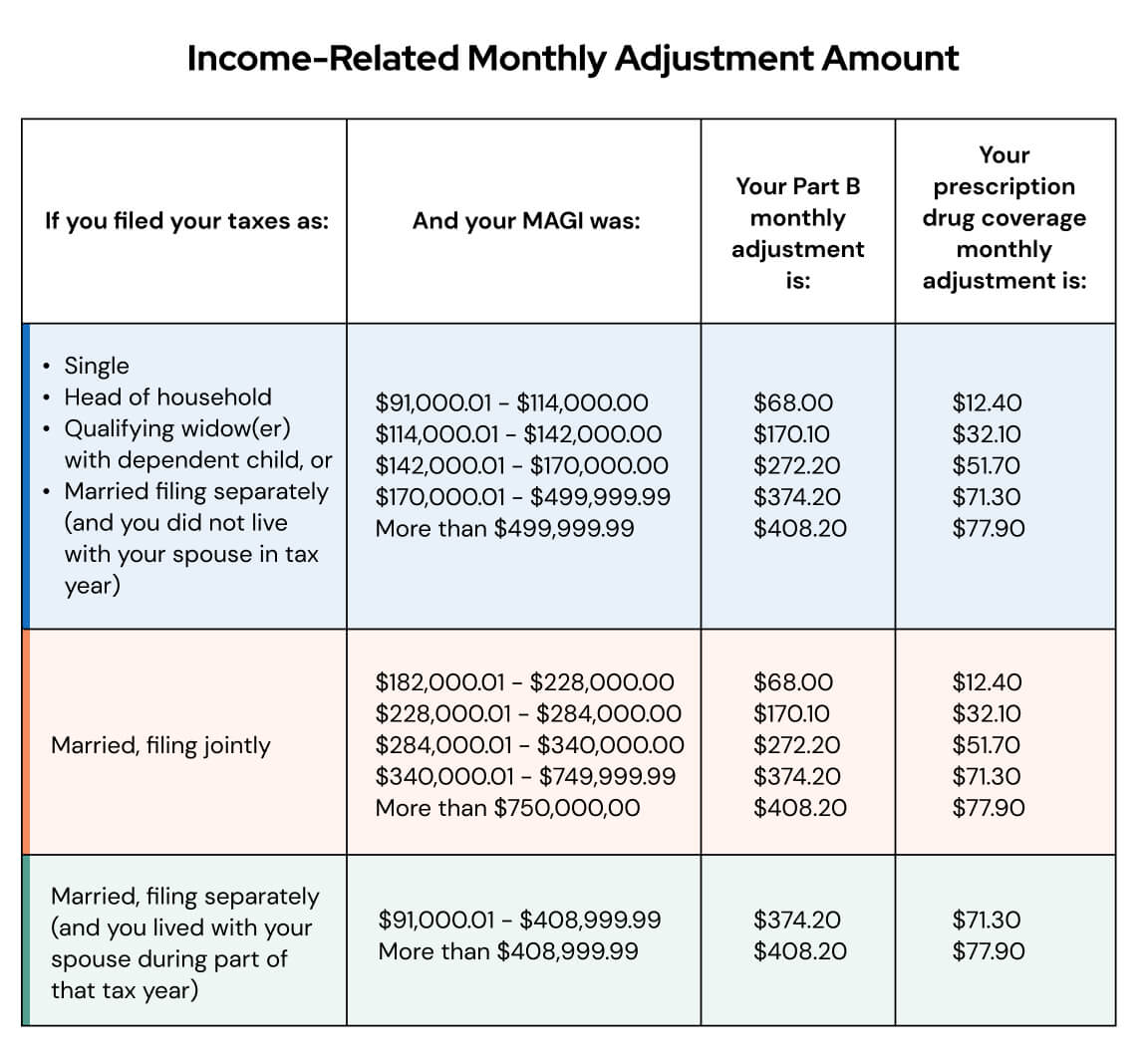

As the new year approaches, Medicare beneficiaries are eager to learn about the changes that will affect their Part B premiums. One crucial aspect to consider is the Income-Related Monthly Adjustment Amount (IRMAA), which determines the amount of additional premium beneficiaries with higher incomes must pay. In this article, we will delve into the 2025 IRMAA brackets for Medicare Part B and provide essential information to help you navigate these changes.

What are IRMAA Brackets?

IRMAA brackets are used to determine the additional premium amount that Medicare beneficiaries with higher incomes must pay for their Part B coverage. The Centers for Medicare and Medicaid Services (CMS) adjust these brackets annually to reflect changes in the cost of living and healthcare costs. The 2025 IRMAA brackets will be based on the beneficiary's modified adjusted gross income (MAGI) from their tax return two years prior.

2025 IRMAA Brackets for Medicare Part B

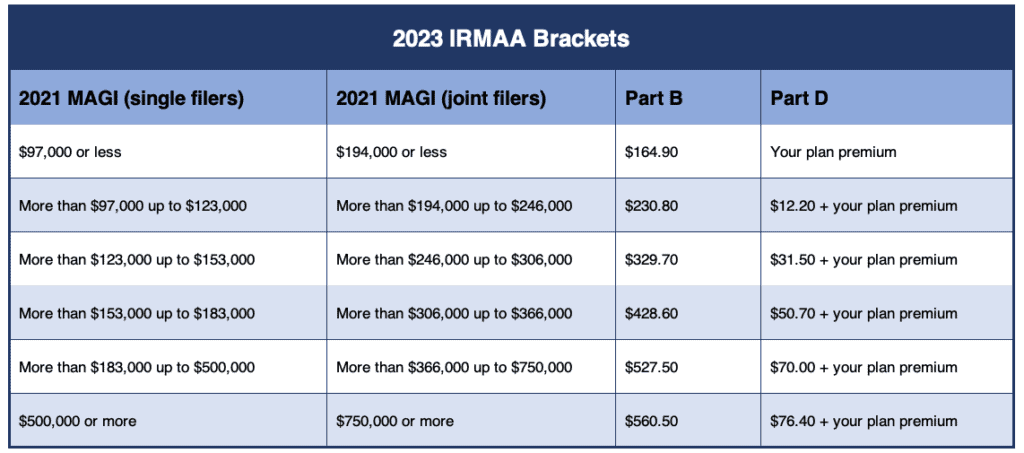

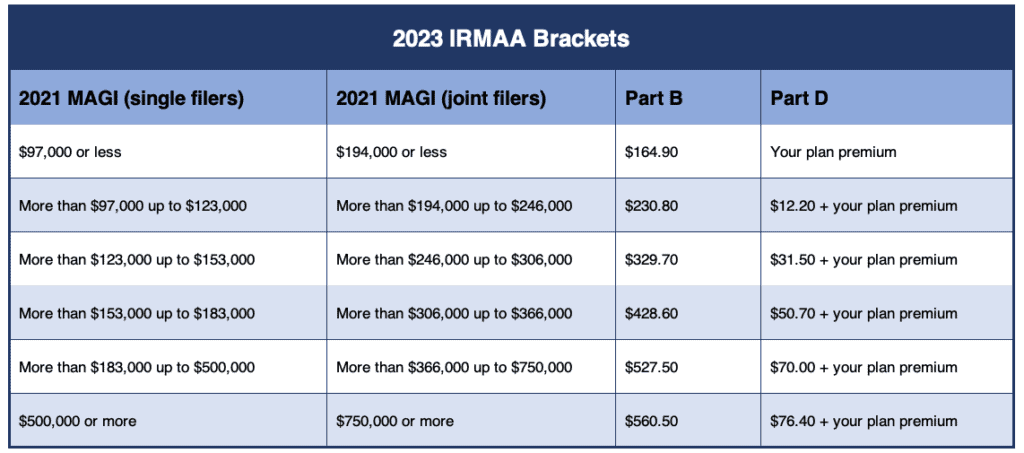

The 2025 IRMAA brackets for Medicare Part B are as follows:

Beneficiaries with a MAGI of $97,000 or less (or $194,000 or less for joint filers) will pay the standard Part B premium of $164.90 per month.

Beneficiaries with a MAGI between $97,001 and $123,000 (or $194,001 and $246,000 for joint filers) will pay an additional $65.90 per month, for a total of $230.80 per month.

Beneficiaries with a MAGI between $123,001 and $153,000 (or $246,001 and $306,000 for joint filers) will pay an additional $136.90 per month, for a total of $301.80 per month.

Beneficiaries with a MAGI between $153,001 and $183,000 (or $306,001 and $366,000 for joint filers) will pay an additional $207.90 per month, for a total of $372.80 per month.

Beneficiaries with a MAGI between $183,001 and $213,000 (or $366,001 and $426,000 for joint filers) will pay an additional $278.90 per month, for a total of $443.80 per month.

Beneficiaries with a MAGI above $213,000 (or $426,000 for joint filers) will pay an additional $349.90 per month, for a total of $514.80 per month.

How to Reduce Your IRMAA

If you are concerned about the impact of IRMAA on your Medicare Part B premiums, there are steps you can take to reduce your MAGI and potentially lower your IRMAA:

Consider contributing to a tax-deferred retirement account, such as a 401(k) or IRA.

Look into tax-loss harvesting to offset capital gains.

Consult with a financial advisor to optimize your income and reduce your tax liability.

The 2025 IRMAA brackets for Medicare Part B will have a significant impact on beneficiaries with higher incomes. Understanding these changes and taking proactive steps to reduce your MAGI can help minimize the financial burden of IRMAA. As you navigate the complex world of Medicare, it is essential to stay informed and seek professional guidance to ensure you are making the most of your benefits. By staying ahead of the curve, you can make informed decisions about your healthcare and financial well-being.

Note: The information provided in this article is subject to change and may not reflect the actual 2025 IRMAA brackets. It is essential to consult the official CMS website or a licensed insurance professional for the most up-to-date and accurate information.